关注公众号

关注公众号

“超越预算”是一个企业管理和管理会计领域近年诞生的新概念。如果您听说过,说明您已经走到了FP&A领域非常前沿的位置。

与传统预算以企业管理者用权威给各部门制定固定预算不同,超越预算主张把预算权下放给各个业务部门,并且不做出任何限制!你也许会认为这种想法很疯狂,但以澳大利亚罗氏制药等跨国企业已经取得了阶段性的成功。

超越预算也是一套全局性管理变革,要求公司的每个员工有足够的自律和责任心,因此也非常具有颠覆性和革命性。换句话说,它要求员工要对公司有着非常亲切的认同,才不至于“乱花公司的钱”。

学习委员整理了一篇泛亚FP&A数字化协会峰会的访谈,先后有四名专家提出了对超越预算的见解和看法。让我们看看这样激进的概念有可能实现吗?

As more and more enterprises endeavor to move from a centralized, command and control structure to more agile and decentralized business units, the biggest constraint felt by many is the way financial control is exercised via traditional budgeting and budgetary control. At the Digital Pan Asian FP&A Board, the panel of four high-profile speakers discussed the challenges, learnings and benefits of moving from traditional to better and beyond budgeting.

随着越来越多的企业努力从集中式、指令式和等级制组织机构转向更灵活和分散的业务单位,许多企业感到的最大难点是依然遵循传统的预算和预算控制来实施财务控制的方式。在泛亚FP&A数字化协会峰会上,4名发言专家探讨了从传统预算到超越预算的挑战、经验和优势。

The article starts with an introduction to the beyond budgeting concept, lists practical aspects learnt from Roche Australia’s experience and explains how technology can be leveraged in this process.

本文将从介绍超越预算这一基本概念开始,为大家陈列出澳大利亚罗氏药业的经验并解读如何将这一技术运用到实际上。

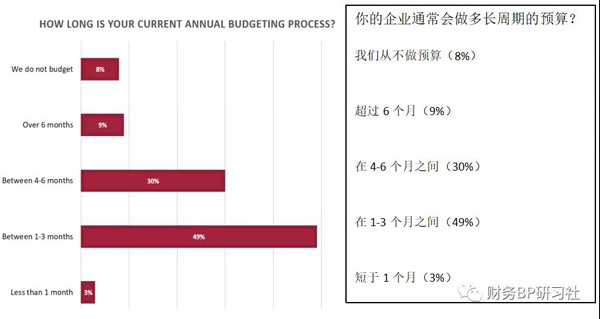

Fig 1. Results of the webinar poll #1 (among participants)

图表1.根据网络研讨会调查结果(参与者投票)

1

Why is traditional budgeting becoming irrelevant?

为什么传统预算方法变得不合时宜了?

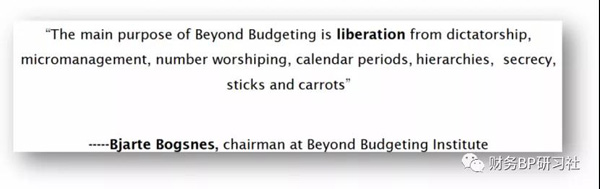

超越预算的目的,就是从把企业从一言堂、微观管理、数字崇拜、季度月份、等级制度、保密隐瞒和胡萝卜加大棒政策中解放出来。——Bjarte Bogsnes,超越预算研究会主席

Rikard Olsson, Managing Director at Beyond Budgeting Roundtable, explained how the current traditional budgetary control system was devised in an era that was far different from the times we currently live in.

超越预算圆桌会议的协会理事Rikard Olsson解释道,我们当下使用的传统预算控制系统诞生于与一个今天截然不同的年代。

The traditional budget system used by most companies today was founded almost a century ago. The basis of this system was that there is a center of power with the top leadership and then based on their intelligence, targets are decided once a year, then these are broken down by the lowest level of control points and then monitored for adherence.

传统预算体系几乎有100年历史了。这套系统的基础建立在一个最高领导层主导的权力中心之上,他们根据掌握的信息每年制定一次目标,然后目标再被下面的基层拆解,再被考核是否能完成。

Variance analysis plays a crucial role in the analysis and every month/quarter variances by factory, product, business units etc. were done by controllers vis-à-vis the budget and the rewards and recognition would flow in sync with this.

每个月或季度,分析工厂、产品、业务单元等主体的变动情况至关重要。绩效奖励和预算就是根据它们的变化而同步变化。

However, with the business and competitive landscape changing rapidly, the old way of working is being found very restrictive. Despite doing a good job vs the fixed budget, companies were not being successful at the end of the year due to the changes around it.

然而,随着商业和竞争格局的迅速演变,旧的工作方式开始体现出局限性。尽管固定预算之下公司经营状况还属不错,但由于外部环境的改变,公司可能到年底就不尽如人意了。

It further creates a silo mentality of “spend or lose”, local optimums vs global benefits, sub-optimal allocation of resources and an extremely slow response to changes as everything is stuck when finance stops an investment as it is not budgeted.

更重要的是,它进一步营造了一种“年底必须花掉(预算),否则下个季度就没得花”的孤立主义,使得公司的局部部门和公司整体形成了一种对立关系。反之一旦预算不足,业务部门就只能做出委屈求全谋取次优的资源配置,并且公司对这一情况的反应也相当迟钝。

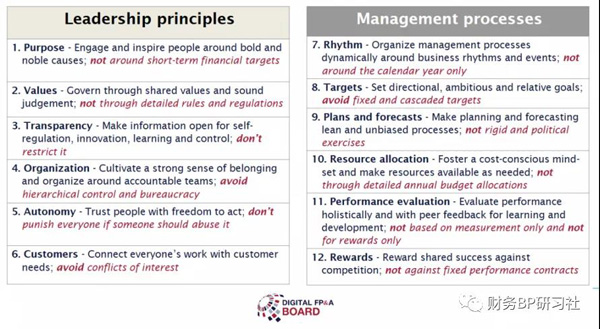

The below table shows the basic principle of “Beyond Budgeting”. For finance, the right side is the more relevant aspect to focus upon.

下表罗列了“超越预算”的基本原则。对于财务人员来说,右边部分更与我们关注的问题相关。

A few prerequisites of beyond budgeting that need to be taken care of are as follows

超越预算还需要注意的几个前提

1.Dependence on an annual (or calendar based) budget cycle should be avoided. This provides managers with flexible forecasting cycles instead that are aligned with new events in your industry to cover the specific new opportunities/risks that have arisen.

1.不要基于年度(或基于日历的)的制定预算周期。业务经理需要灵活的预测周期,预测周期应该与行业的自身周期或发生的事件相耦合,这样才能考虑到已经出现的特定的新机会/风险。

2.Fixed targets should be abandoned. The targets have to keep moving in sync with the latest changes in the landscape. This ensures that the targets are realistic and relevant.

2.不要墨守定死的目标。目标必须与最新的行业形势同步变化,这才能保障目标和现实是相关的。

3.The planning and forecasting cycles should be de-politicized. People should be encouraged to come up with their ideas and involvement at different levels is set by the company strategy.

3.财务规划和预测周期应去等级制。应该鼓励员工提出自己的想法,不同职级的员工都能参与到公司战略的制定。

4.Resource allocations should not be based on the once-a-year budget assumptions. They need to be dynamic and flexible to move between products and geographies depending on the changing circumstances.

4.资源分配不应基于年度预算假设。应该灵活地根据实际情况实际情况和地理位置分配各地区的资源。

5.Performance evaluation should be based on holistic achievements of targets and not based on full or over achievement of an independent unit. Rewards should be against relative performance by competition and not based on fixed targets.

5.绩效评价应以目标的全盘完成为基础,而不是以某个独立单位的完成指标与否为基础。奖励应针对竞争对手的相对表现,而不是基于固定的目标。

6.There needs to be a clear movement from variance analysis to trend analysis. Currently, the focus shifts to business acumen from a pure financial acumen as finance is required to understand the drivers of the business and how they interact with each other.

6.应该把思维从差异性分析转变到趋势性分析上。要从单纯的财务思维转移到业务思维上,因为财务需要了解业务的驱动因素以及他们如何相互之间如何合作。

2

Beyond budgeting: Experiences and lessons from Roche Pharmaceuticals, Australia

超越预算:澳大利亚罗氏制药的经验教训

Adri de Vleeschauwer, Chapter Lead - Business Advisory at Roche, and Stefan Plattner, Finance Director and Community Lead Future at Rohe, spoke about their personal experiences while implementing beyond budgeting at Roche Australia. To succeed, this initiative had to start top-down with strong leadership support. In Roche, they had a clear 10-year vision of what they wanted to do and everything was subordinated to achieve this.

罗氏制药首席业务咨询官Adri de Vleeschauwer和罗氏制药财务总监兼未来社区总监Stefan Plattner谈及了在公司实施超越预算的一些经验。想要取得成功,超越预算需要有力的管理层做自上而下的推行。对此,他们做了为期10年的远景规划,并且目前正在有条不紊地运行。

They achieved this through some specific steps

他们通过一些具体的步骤达成了一定成就:

1.No bottoms up budgeting meant no hoarding of budgets by cost center managers who were accustomed to getting their budgets slashed if they didn’t spend.

1.不做自下而上的预算,意味着成本中心经理不会囤积预算。成本中心经理习惯于预算不花光就被削减预算,所以到年底会疯狂花掉预算。这种情况得到了避免。

2.All employees were encouraged to let go of their narrow mindset and do the cap of “enterprise management”. They needed to ask themselves how their decision would affect the whole enterprise rather than just their division or geography.

2.鼓励所有员工摒弃狭隘的心态,每个人都应该是“企业管理”的一份子。他们需要问自己,他们的决定会怎么影响整个企业,而不仅仅是他们的部门或管辖的大区。

3. The company changed the targets from individual and country-level ones to a single global target. The rewards were also shifted from an individual level to team levels to foster collaboration. This required a major mindset shift. Roche had to deal with the resistance that arose from the uncertainty and unfamiliarity.

3.公司将目标从个人和国家级别变更到实现全球目标。奖励机制也从个人一级转移到团队一级,以促进协作。这需要很大的思维方式转变。罗氏也因此必须应对由不确定性导致的的阻力。

4.There was a shift from a strict “need to know” basis to a more open data visibility to employees. This helped teams evaluate themselves and their performance and contribution to the global goals.

4.从过去严格的“必须知道”变为对员工开放更多透明的数据,帮助团队评估自己和他们的表现,以及对全球目标的贡献。

5.The company educated its employees. If there is no budget, this does not mean a blank cheque book.

5.公司要教育员工。没有预算这并不意味是给一个空白的支票簿随便填。

They managed to achieve the following:

他们取得的成就有:

190 days of company time saved; 2,700 slides eradicated

节省公司190天的时间;少费了2700张幻灯片

More transparency and visibility to the employees on spends and investments

提高了员工对支出和投资的透明度和可见度

Higher ROI on investments due to better focus

投资回报率在聚焦目标之后取得改善

Faster cycles of forecasting meant better agility to make required course corrections

更快的预测周期意味着能更灵敏地修正行动方针

Avoiding hockey stick spend at year-end, sandbagging of sales targets

避免年底出现“曲棍球杆效应”(译者注:曲棍球杆效应,指考核季末业务团队疯狂用掉没用完的预算,折线图形似曲棍球杆,助长业务部门的投机甚至腐败行为)

3

On role of technology

技术工具的作用

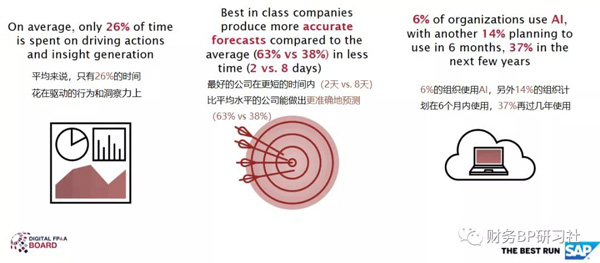

Pras Chatterjee, Senior Director at SAP, shared some interesting numbers (see the slide above).

SAP的高级董事Pras Chatterjee分享了一组有趣的数据(见上图)

He explained how cloud-based planning can help to move to the new era of financial planning. While today most of the companies use excel for analysis, traditional tools have several shortfalls. For example, companies struggle with using them as a collaborative tool that multiple users can use at the same time across the globe.

他分析了基于云计算规划如何帮助业界走向财务规划新时代。虽然今天大多数公司都使用excel来进行分析,但传统的工具有几个缺点。例如,企业很难将它们当成协同工具,供其他国家多个用户可以同时使用。

Modern technologies are enterprise-ready which means that they are ready to be used without the need to have a full-time data scientist on the roles. The information provided by the modern tool would provide predictive planning insights and valuable insights readily, simulate future outcomes and prepare the presentation in a very appealing visualization.

(SAP这样的)现代化技术已经准备好为企业提供服务了,所谓“准备好”的意思是企业不需要专职的科学家了就能运作它们。现代工具提供的信息将即时提供预测性的规划洞察和有价值的见解,甚至模拟未来的结果,并以引人注目的可视化方式呈现出来。

Implementing such tools would help finance to move from the back of the boat to the front of the boat where finance manages by looking at future trends rather than the past variances. In a nutshell, it will help teams to make faster and more confident decisions.

这些工具的运用将帮助财务部门从船的后部移动到船的前部,在那里,财务通过观察未来的趋势而不是过去的差异来进行管理。简而言之,它将帮助团队做出更快捷、更自信的决策。

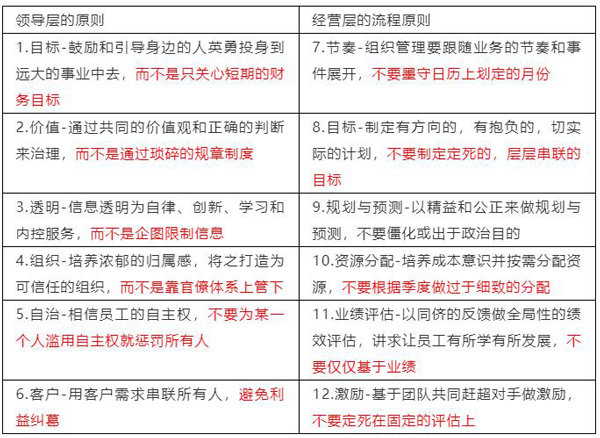

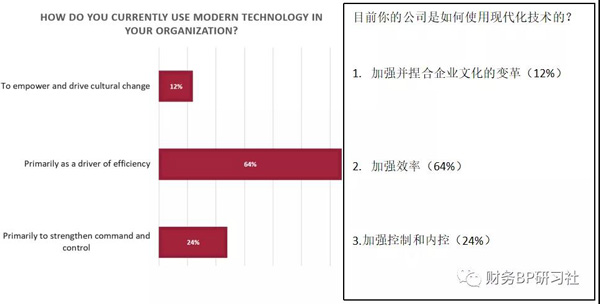

Fig 2. Results of the webinar poll #2 (among participants)

图表2.根据网络研讨会调查结果(参与者投票)

4

In Conclusion

总结

Any transformation has three critical components:

任何变革都需要三个至关重要的条件:

People and their mindset

人和他们思维

Processes

流程

Technology

技术

It is critical that we approach the transformation in a holistic manner that addresses all three aspects of the transformation. Remember that the full exercise is a continuous journey and not a one-stop. The most important step is the first step on the journey by letting go of the uncertainty of not having a budget. Today most companies have their FP&A team spending way more time on planning than on analysis. It is time to reconsider this.

重要的是,我们正在以一种全局性的方式来推动变革。记住,全局变革是一个持续性的进程,而不是一蹴而就。最重要的一步是迈出那第一步——在面对预算的不确定性时候能顺其自然。如今,大多数公司的FP&A团队把做更多分析的时间花在了做计划上。是时候重新考量这个问题了。